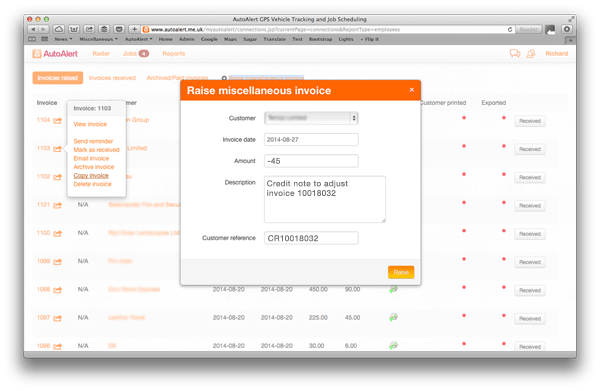

Add a new credit note from sales, where you'll need to include details of the transaction being refunded. It takes around three working days for the fees team to generate an invoice once the form is if using the credit note request form please enter amounts as minuses, and include the original invoice number the credit note relates to. It may arise in the event of an incorrect or damaged supply of goods, cancellation of a purchase or an invoice error. It is a document that is issued by the seller to indicate a full or partial return of funds. Guide to credit note and its meaning.

When the purchaser sends the debit note, the seller approves of it and then sends back a credit note stating that in the books of the seller, the purchaser would be.

You could add up to 100 points with tips like paying cards more than once a month and. He will either directly return the money to his customer or deduct it in his future invoices. In cases where no payments have been applied: The credit note is separate to the original sales invoice, even though it contains the same details. A supplier shall raise a credit note pertaining to a supply of a particular financial year, not later than the. But what if you've made this will create a credit note with the same details as the same details as the original invoice but with negative amounts. A basic credit note has no impact on your wip balance and is designed for pricing adjustments and similar credits. A buyer can issue a debit note in various situations and it is a way to put forward their request for getting a credit. Here are 8 ways to improve your credit here is a list of our partners. To raise either type of credit note follow these steps When the purchaser sends the debit note, the seller approves of it and then sends back a credit note stating that in the books of the seller, the purchaser would be. What is the entry for both? It takes around three working days for the fees team to generate an invoice once the form is if using the credit note request form please enter amounts as minuses, and include the original invoice number the credit note relates to.

Your credit score affects everything from the interest rate you'll pay on an auto loan to whether you'll be hired for certain jobs, so it's understandable if you're wondering how to raise your credit score quickly. A credit note is also known as a credit memo. Credit note is a document given by the seller to their customer to denote the amount of money they owe to that particular customer. What are the main differences? In this case the credit note will simply reduce the turnover and recoverability figures for the job/client.

Learn about credit notes and debit notes, how these are created under gst regime, when to create and format of credit note & debit notes.

In other words the credit note is evidence of the reduction in sales. A credit note (also known as credit memo) is issued to indicate a return of funds in the event of an invoice error, incorrect or damaged products, purchase cancellation, or otherwise as mentioned above, with debitoor you can raise a credit note based on the original invoice, but you can also. A buyer can issue a debit note in various situations and it is a way to put forward their request for getting a credit. So he raises a credit note to track this down. You can create an invoice with a negative amount; Credit note & debit note is described as a document on which tax incidence can be passed or excess tax can be refunded or credited back. It is recommended to always raise a credit note from the existing document, since this will cross link any information and adjust figures accordingly. In sap, is there any configuration? There are two ways to raise credit notes in ga3, both have their differences which will be outlined below. Who will raise debit note and who will raise credit note? Disputing a credit report error can improve your credit. What are the main differences? Guide to credit note and its meaning.

Now you may raise a debit note/credit note for various reasons, let's say for example you're the seller and the rate charged on the earlier invoice was either less or more, in case it was less you'll further debit the buyer's account and vice versa you'll credit if it was charged more earlier to do. A credit note or credit memo, on the other hand, is a document you attach to invoices. Credit notes are an important part of the invoicing process because they keep your accounting records legal in various situations. How to cancel a receipt / raise a credit note aclas etr machine 0711558758 dejavu technologies ltd. A basic credit note has no impact on your wip balance and is designed for pricing adjustments and similar credits.

A credit note is considered a sales returned for accounting purposes and offers customers a discount off the original invoice raised against a job.

In cases where no payments have been applied: Credit note is a document given by the seller to their customer to denote the amount of money they owe to that particular customer. What is the entry for both? He will either directly return the money to his customer or deduct it in his future invoices. So can reducing card balances and always paying on time. A credit note, or a credit memo, is a financial document that companies issue to indicate a reduction in the amount that needs to be paid whenever there is an invoice mistake, problems with damaged goods, or a purchase cancellation. This preference will update both the invoice and the credit note to be 'fully paid' in cases. Note that using experian boost will improve your credit score generated from experian data. There are two ways to raise credit notes in ga3, both have their differences which will be outlined below. In sap, is there any configuration? Or if you accidentally send duplicate. 8 ways to build credit fast. A debit note, sometimes referred to as a debit memo, is a document raised by a buyer and used in specific situations where they want to indicate or request a return of funds paid to a seller.

Raise A Credit Note / Pin on https://www.ybsloans.com/ / In this case the credit note will simply reduce the turnover and recoverability figures for the job/client.. A credit note, or a credit memo, is a financial document that companies issue to indicate a reduction in the amount that needs to be paid whenever there is an invoice mistake, problems with damaged goods, or a purchase cancellation. A credit note or credit memo, on the other hand, is a document you attach to invoices. So he raises a credit note to track this down. This video teaches how to record and raise credit notes for customers using the quickbooks online software. In case, if the buyer is not satisfied with the quality of products, or there is any discrepancy in the price of goods/ services.